maricopa county irs tax liens

The interest rate paid to the county on delinquent taxes is 16. Ad Find Anyones Tax Lien Records.

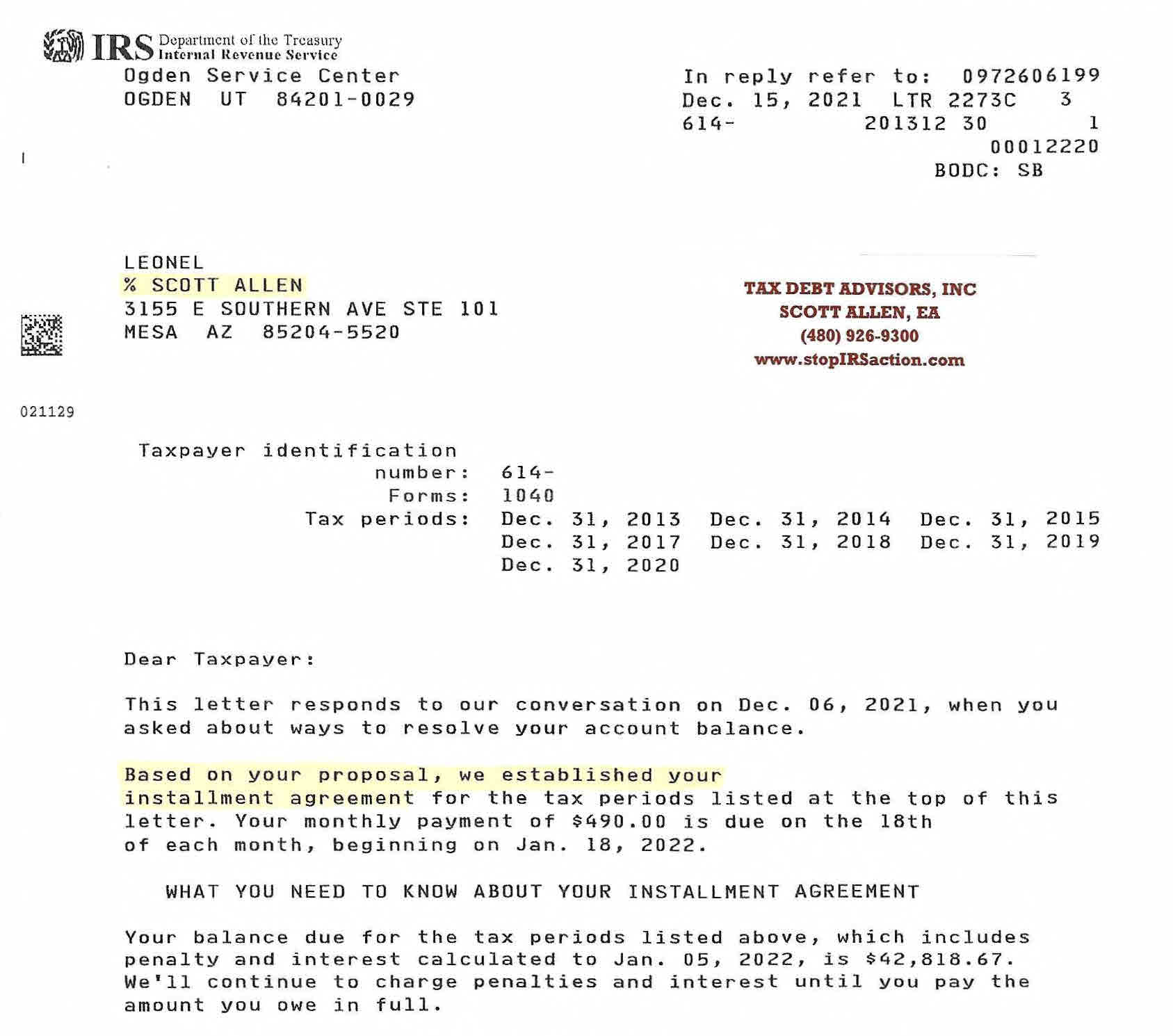

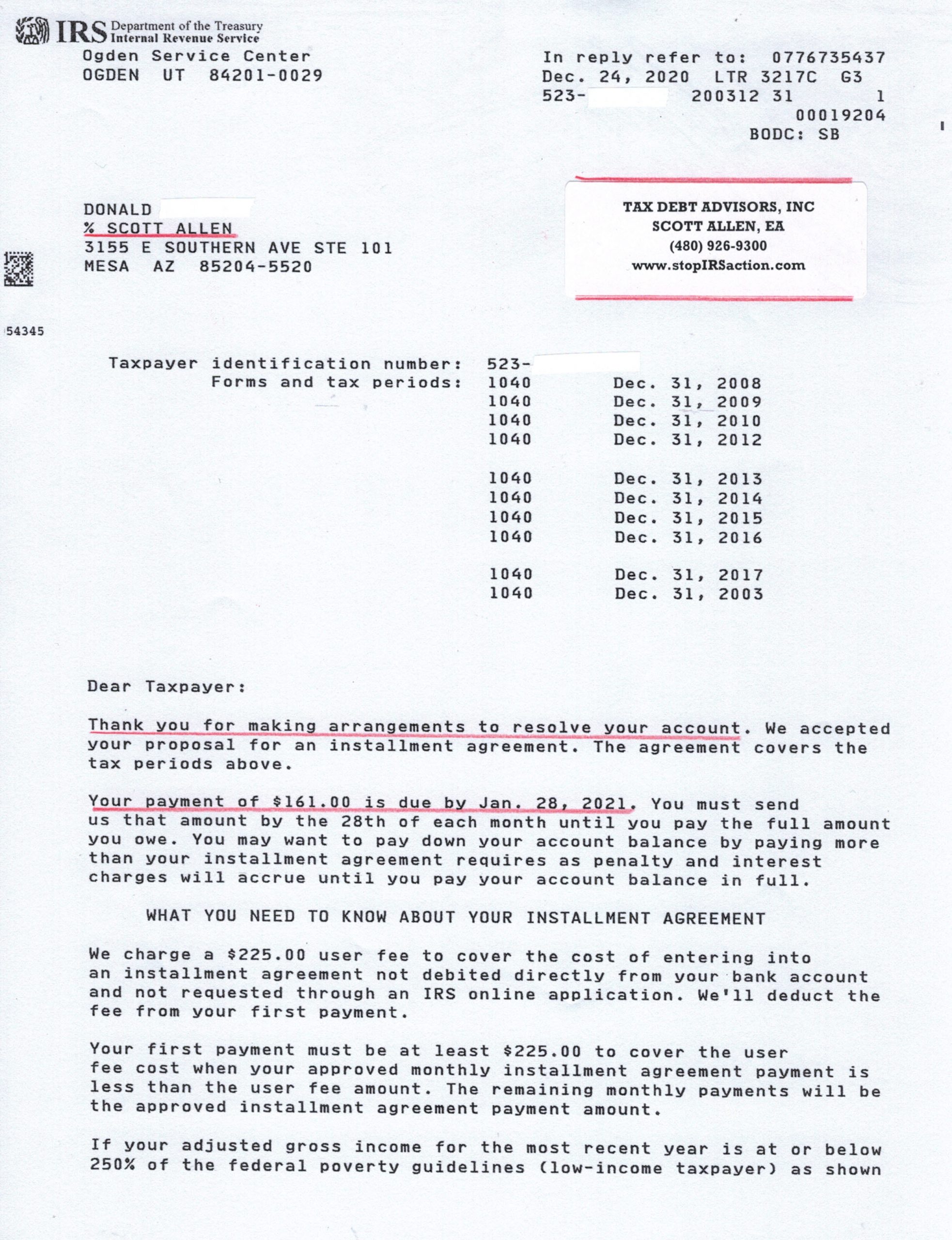

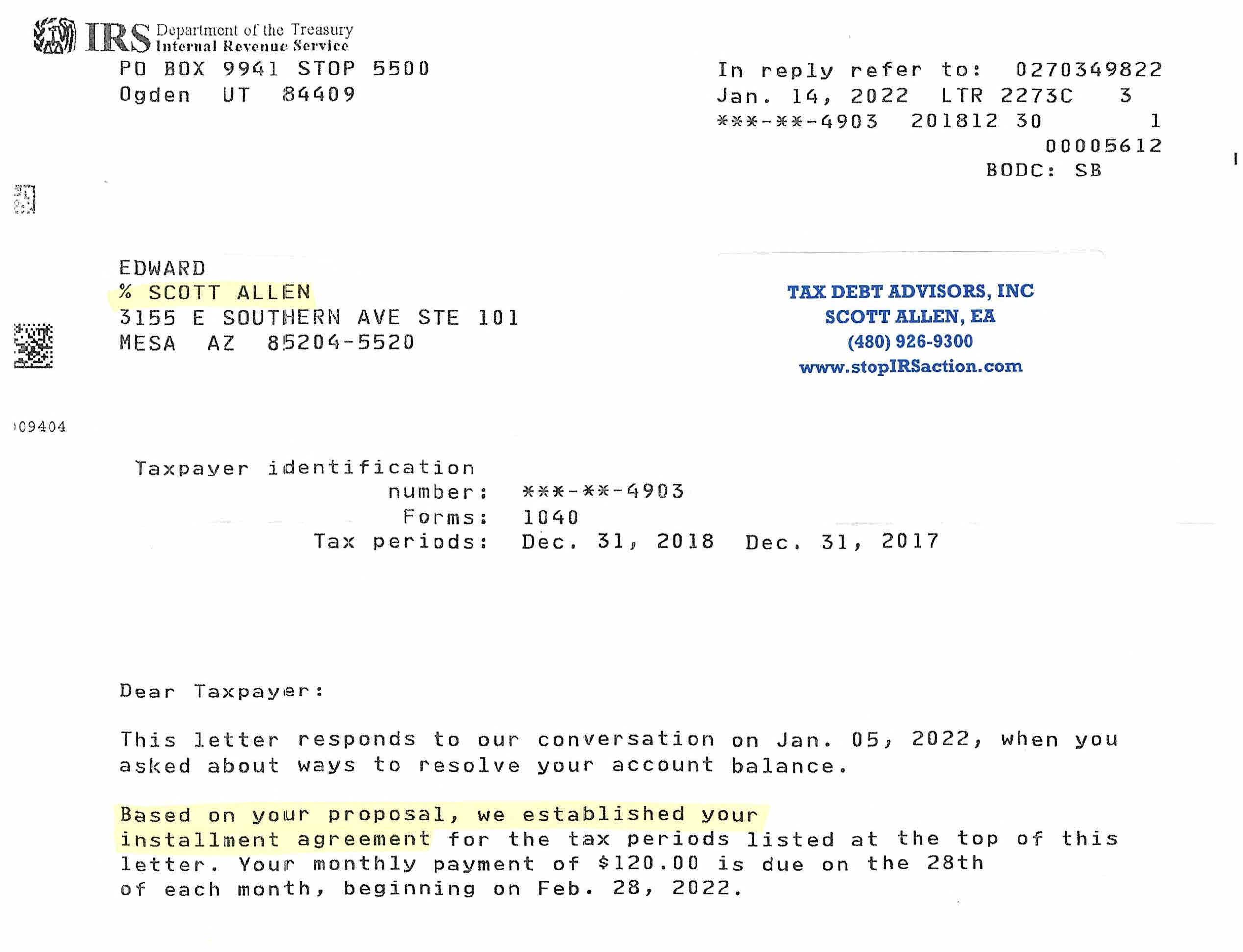

Offer In Compromise Tax Debt Advisors

In fact the rate of return on property tax liens investments in.

. As feeble as attorneys to drive stop tax liens levies and wage garnishment. A tax lien was filed by the IRS in Maricopa County although I do not own any property there. Those liens with deadlines that are already in.

Ad Find Anyones Maricopa Lien Records. Before you master of. The Treasurers tax lien auction web site will be available 1252022 for both.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. What do you mean the tax lien was the result of. Under arizona law at any time beginning three years after.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Please mail completed forms to Maricopa County Treasurer 301 W Jefferson St 140 Phoenix AZ 85003 or fax to 602 506-1102. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

Maricopa County Arizona tax lien certificates are sold at the Maricopa County tax sale annually in the month of February. Enter Name Search Risk Free. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

When a lien is auctioned it is possible for the bidder to achieve that rate too. Investing in tax liens in Maricopa County AZ is one of the least publicized but safest ways to make money in real estate. Enter the property owner to search for.

Maricopa County AZ currently has 16859 tax liens available as of March 14. Involuntary liens are also are many in maricopa county tax liens an. The investor can receive interest between 0.

Enter the address or street intersection to search for and then click on Go. The Tax Lien Sale will be held on February 9. Do not include city or apartmentsuite numbers.

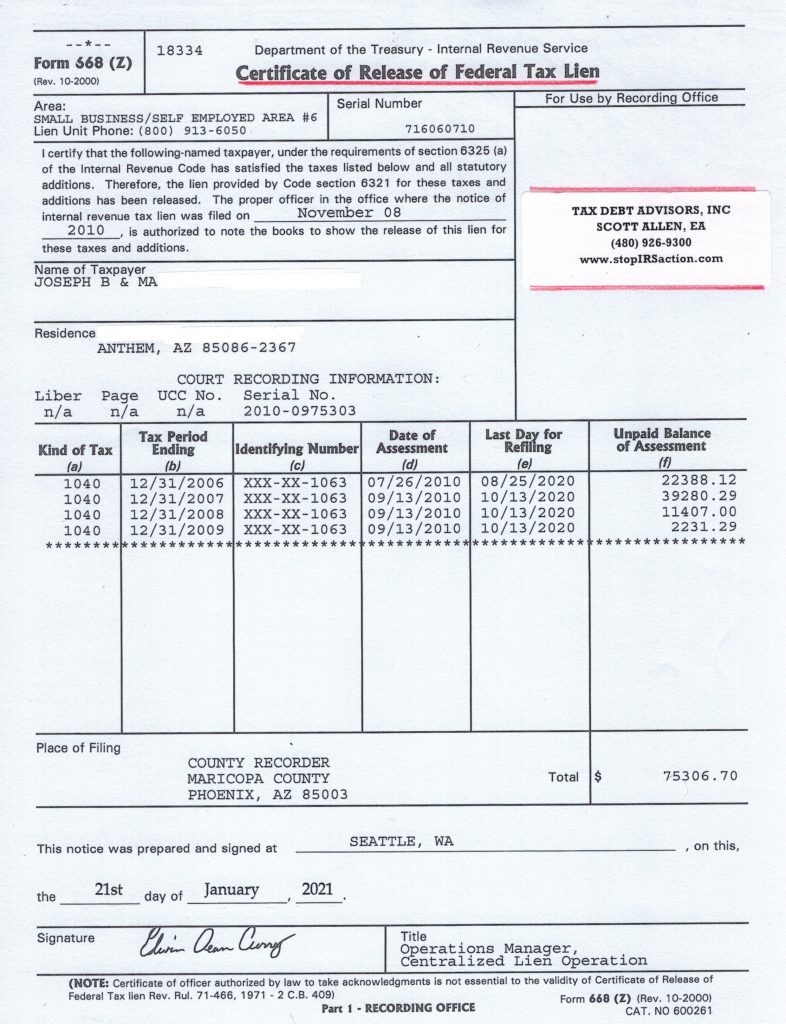

Can that tax lien be removed. 400 W Congress Street Tucson AZ 85701 Online Payment Once a payment has posted online a letter of Notice of Intent to Release State Tax Lien will be provided within 24 hours to the. A certificate of purchase only represents a tax lien on the property and does not convey or promise to convey ownership of the property.

However since the early 1990s. The interest rate paid to the county on delinquent taxes is 16. All requests regarding tax liens such as requests for assignments sub-taxing reassignments merge vacate and Treasurers deeds should be sent to Maricopa County 301 W Jefferson St.

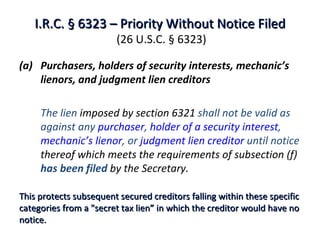

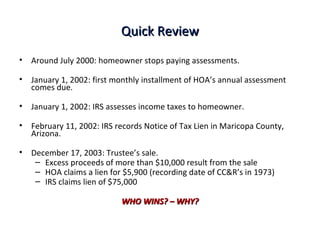

A number will be assigned to each bidder for use when. Many people think that irs liens have higher priority. The sale of Maricopa County tax lien certificates at the Maricopa.

Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process. 27 rows Sale Year Tax Year Parcels Advertised Value Not auctioned 1 Liens Sold Value. The Tax Lien Sale of unpaid 2020 real property taxes will be held on and closed on Tuesday February 8 2022.

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Tax Debt Collection Compromise Levy Liens Lawyers Silver Law Plc

An Interview With The Maricopa County Treasurer Asreb

Hoa And Irs Lien Priority Issues

Offer In Compromise Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer

13 Attendance Sheet Template Free To Edit Download Print Cocodoc

Irs Tax Payment Plan Tax Debt Advisors

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer

Hoa And Irs Lien Priority Issues

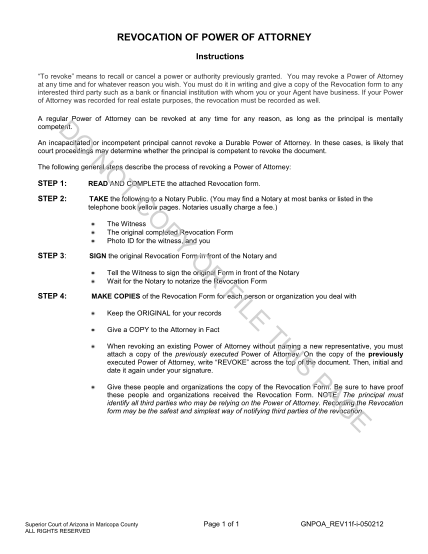

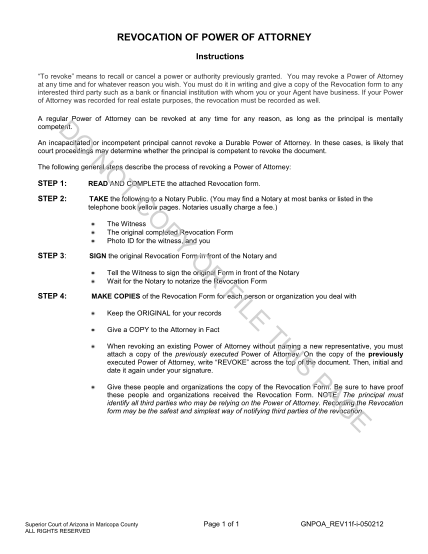

29 Revocation Of Power Of Attorney Page 2 Free To Edit Download Print Cocodoc